It feels like we’ve all lived a decade in the last year, doesn’t it? There is no shortage of headlines, stories, and narratives that have filled our televisions, phones, and brains. Most of these are things we will remember and tell our kids and our grandkids. They are generation-defining events.

There is another story that is taking shape and will likely be a major headline for the next 12 months. It may not take over your every moment like a global pandemic, but major tax changes in the United States will have a serious impact on your wallet if you are an NFL Player. The headlines only go so far to say the government will “tax the wealthiest 1%”. In case you didn’t know, NEARLY ALL NFL PLAYERS are in the 1% of income earners in the United States whether you are a highly-paid veteran or an undrafted free agent. (The Top 1% of US Income Earners earn $758,434 or more, while the AVERAGE NFL Player earns almost 5 times that, or $3,425,455).

So, what type of impact are we talking about here? Well, there are two major changes being proposed that if passed would have a significant impact on your take-home pay. Here they are, and some ideas on how to calculate the impact it may have on your paychecks.

-

Increase of the top Income tax rate from 37% to 39.6%

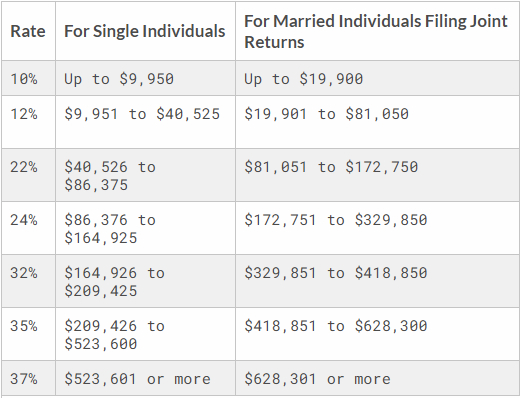

The United States uses a PROGRESSIVE income tax model, where the more you make, the higher tax you pay. So, essentially, the first dollar you earn is taxed at a lot lower rate than your last dollar. See tax brackets below:

While an increase from 37% to 39.6% may not seem like a lot (only 2.6% right?), when you do the math below, you see just how much additional tax you will pay:

- If you are single, take your total annual earnings and subtract $523,600. If you are married, take your total annual earnings and subtract $628,300.

- Now take that number and multiply it times .026 (2.6%). That is your additional tax.

- With the average NFL Player earning $3,425,455, that increase is $75,448 for a single and $72,726 for a married player.

- Increase in limits for social security

- Started in the 1930’s, The United States Social Security plan is essentially a universal pension, meaning that while you work, you contribute to the plan, and when you retire (in your late 60’s), you get a monthly payment from the government. Over the years, as U.S. Citizens have begun living longer, this pension plan has become underfunded, meaning that there is more expected to be paid out than paid in.

- In an effort to shore up this deficit, President Bidens’ tax plan proposes increasing the limits on income for Social Security Contributions. Currently, only your first $137,700 of income tax is counted for social security contributions. You pay 6.3% on that income, or $8,680 annually. If you earn more than $137,700 (remember, all of you do as long as you play a full season), you are not required to pay the 6.3% on income above the $137,700 mark. The proposed changes add that 6.3% income back on to all income in excess of $400k. So, this is an even bigger increase than the top tax rate increase (as shown above).

- T Take your income and subtract $400,000. Now multiply that number times .063 (6.3%). That would be your additional Social Security Income Tax as currently proposed. For the average NFL Player, this increase is $190,603.

- You may be asking, if I pay an extra $190k into Social Security, will I get more out later? Unfortunately, the answer is a resounding no. Since Social Security is trying to play catch-up, there are no plans to increase payouts to Americans who pay into the vehicle.

- COMBINED, these 2 increases have the potential to account for an additional $264,690 in income taxes for the NFL player earning $3,425,455.

Want to learn more, and discuss steps that may help reduce the amount of income taxes you owe? Contact the SignaturePRO team here.*

*By clicking link you agree to receive emails from SignatureFD.