As the end of 2023 approaches, charitable giving may be at the forefront of your year-end planning. Individuals and families typically seek strategic ways to make a meaningful impact while optimizing their financial planning. We’ve identified three key elements we believe are crucial to philanthropic strategies, allowing donors to navigate tax complexities, maximize their charitable contributions, and help ensure a brighter future for the causes they hold dear.

Before donating, it is important to review the increased standard deduction thresholds to gift in a tax-efficient manner. Each year, taxpayers can either take the standard deduction or itemize expenses. Below, we’ve outlined the 2023 standard deduction rates.

| Filing Status: | 2023 STANDARD DEDUCTION |

|---|---|

| SINGLE | $13,850 |

| MARRIED (JOINT) | $27,700 |

| MARRIED (SEPARATE) | $13,850 |

| HEAD OF HOUSEHOLD | $20,800 |

| OVER 65 OR BLIND (MARRIED) | $3,000 |

| OVER 65 OR BLIND (SINGLE) | $3,700 |

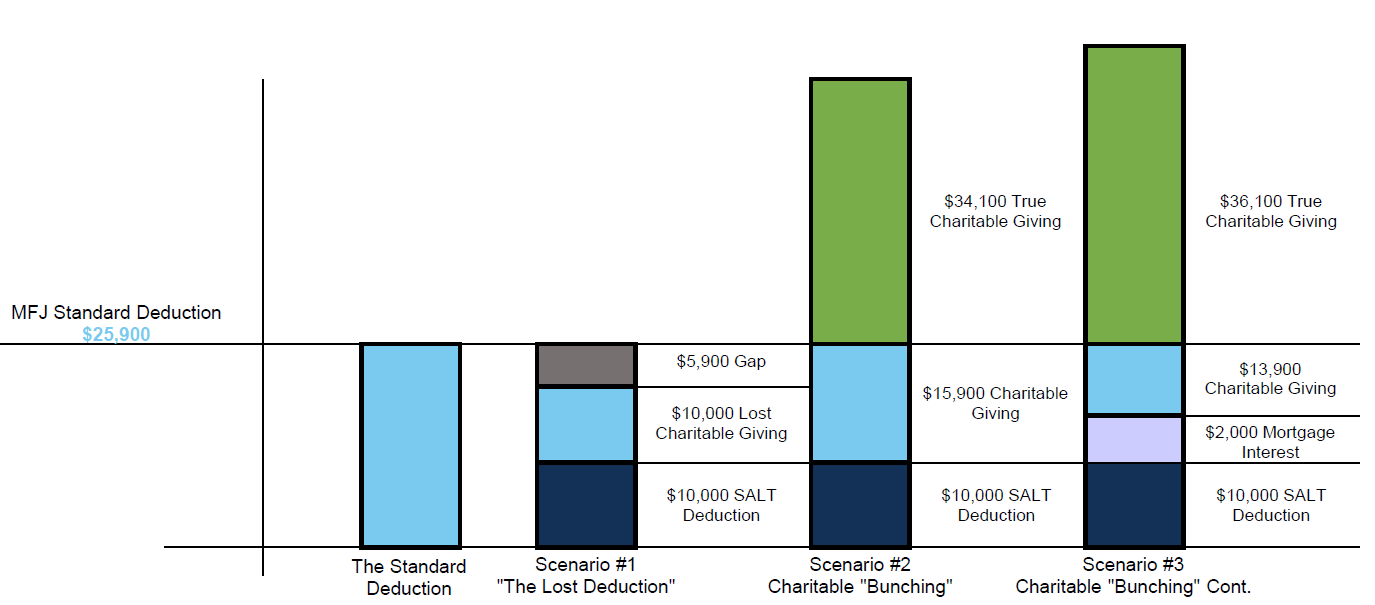

In terms of charitable giving, charitable contributions are deducted from income through an itemized expense report, and the standard deduction acts as a “hurdle” rate. Most taxpayers do not itemize, but those that do primarily deduct state and local taxes (SALT), mortgage interest, and charitable gifts. Please refer to the illustration and scenarios below for further explanation.

Scenario #1 – You should take the standard deduction if your aggregate itemized deductions fall below your corresponding standard deduction. As a result, you’ll be subject to “lost” or “unused” deductions, meaning that your charitable gift does not receive a tax deduction.

Scenario #2 – To reduce lost deductions, consider the timing of your gifts. For example, if you typically give $10,000 annually, you could gift $50,000 this year to fund the next five years of your giving. This strategy is referred to as “charitable bunching.” As a result, you exceed the “hurdle rate” and deduct your itemized expenses in the year you chose to “bunch your gifts.”

Scenario #3 – As you incorporate more itemized deductions (such as qualified mortgage interest), your “bunching” offers a greater tax benefit.

When considering charitable gifts, please note that charitable deductions are limited by your adjusted gross income (AGI). Deductions for charitable cash contributions are limited to 50% or 60% of AGI (depending on whether you give capital gain property in addition to the cash). So, if your AGI is $100,000, you could deduct up to $50,000 or $60,000. Long-term appreciated assets (such as stock held for more than a year) are eligible for a deduction of up to 30% of AGI to most charities and donor-advised funds. If you exceed these limits, you can carry forward the deduction for up to five years, which applies to all contributions.

When navigating the charitable giving space, we believe consulting your CPA and financial advisor is important. Below are two charitable giving strategies that may be leveraged for your year-end giving.

Donor-Advised Funds (DAFs): In this strategy, you gift cash or appreciated assets to a donor-advised fund and receive a charitable deduction for that year. This deduction also applies to any “charitable bunching” strategies. At the time of gift, you do not need to specify which charities you want to support. When you are ready to distribute funds from the DAF, you submit a grant recommendation naming the charity or charities of your choice. A DAF can be an excellent tool to gift appreciated, long-term (a holding period of longer than one year) assets. SignatureFD partners with several DAF platforms including Schwab Charitable, Fidelity Charitable, Cobb Community Foundation, Community Foundation for Greater Atlanta, Foundation for the Carolinas, and National Christian Foundation.

Qualified Charitable Distributions (QCDs): This strategy is effective if you are age 70 ½ or older. To complete a QCD, you allocate up to $100,000 from your IRA and send it directly to a charity. The QCD will count towards your required minimum distribution, if applicable, but will not count toward your taxable income. With a lower adjusted gross income through avoiding taxable RMDs, you may qualify for lower income taxes, Medicare IRMAA, tax credits/deductions, among other benefits. Please note, a QCD may not go to a donor-advised fund.

Remember, working with your CPA and financial advisor can help you follow the IRS rules and navigate the nuances. For instance, you become ineligible for QCD treatment if the funds come directly to you or if they don’t end up with a qualified charity. Additionally, the reporting from your IRA custodian will typically not show the completion of a QCD. Therefore, your CPA must manually add this to your 1040 tax form – something often missed without watchful advisors.

Of course, it is always important to start by asking why. The “why” for most charitable contributions is not simply to gain a tax deduction but to give back to the communities and people you care about.

At SignatureFD, we believe giving is a key to finding your Net WorthwhileTM. Contact Elizabeth Burdette, Director of Giving, to learn more about our approach to strategic generosity and to start your personalized Generosity Blueprint journey.